For many, renting has been the default choice when homeownership feels out of reach. It’s convenient, flexible, and doesn’t require a massive upfront investment. But what if staying in a rental is actually setting you back financially? renting vs owning

A recent Bank of America study found that 70% of prospective buyers fear the long-term consequences of renting, including:

- Rising rental costs

- No equity or wealth-building opportunities

- Lack of financial stability

If you’ve ever questioned whether renting is really the best choice, you’re not alone. Many renters feel stuck—watching home prices climb while their rent payments disappear into their landlord’s pocket each month.

Let’s break down why homeownership is a financially smarter decision, why waiting to buy is costing you, and how Burson Home Advisors’ Lease-to-Own program offers an innovative way to own a home—starting today.

The Rising Cost of Renting vs Owning

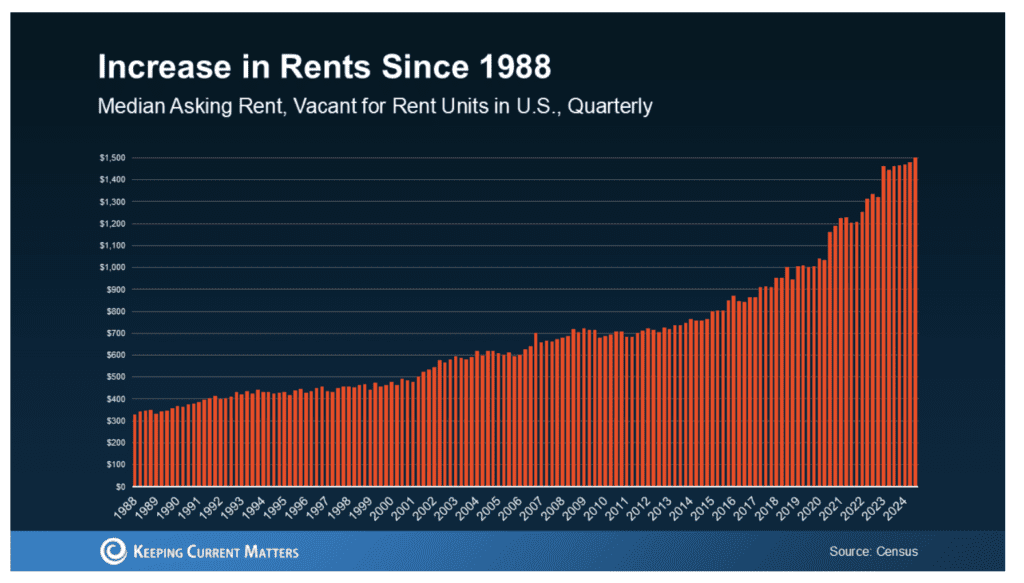

If you feel like rent prices have skyrocketed, you’re absolutely right. According to Census data, rent prices have steadily increased since 1988, and the trend shows no signs of slowing down.

📊 Median Asking Rent, Vacant for Rent Units in U.S., Quarterly

(Source: U.S. Census, Keeping Current Matters)

What This Means for Renters:

- Your rent will likely keep rising—making it harder to budget and plan long-term.

- You have no return on investment—every rent check builds your landlord’s wealth, not yours.

- You’re losing purchasing power—higher rents make it harder to save for a home.

Think about it: if you’re paying $2,000 per month in rent, that’s $24,000 per year going to your landlord. Over five years, you’ll have spent $120,000 on rent—without owning a single brick of the home you live in.

Now, let’s compare that to homeownership.

Homeowners Build Wealth—Renters Do Not

Owning a home isn’t just about having a place to live—it’s one of the most effective ways to build wealth.

Why Homeownership is a Financial Game-Changer:

✔ Your mortgage payment builds equity—instead of paying off someone else’s asset, you’re paying into your own future.

✔ Home values rise over time—allowing you to build significant wealth through appreciation.

✔ Fixed payments provide financial security—unlike rent, which rises nearly every year, your mortgage remains predictable.

📊 Average Sales Price of Homes in the U.S., Quarterly

(Source: U.S. Census, HUD, Keeping Current Matters)

The Reality of Mortgage Payments vs. Rent

Many renters hesitate to buy because they believe monthly mortgage payments are too high. While today’s interest rates may make mortgage payments seem steep, here’s what most people don’t realize:

✅ For the first 18 years of a mortgage, the majority of your payments go toward interest—not home equity.

✅ Our Lease-to-Own program flips this dynamic, allowing you to build equity from DAY ONE—without paying the high interest rates that come with a traditional mortgage.

This means that in our program, more of your monthly payment contributes to your future ownership—putting you in a stronger financial position faster than traditional homeownership.

The Lease-to-Own Advantage: How to Break Free from Renting

If you’ve wanted to buy but feel stuck due to:

- High down payments

- Strict mortgage qualifications

- Unpredictable interest rates

Burson Home Advisors has a better way.

Our Lease-to-Own Program Offers:

✅ Move In with Just 2% Down – The average first-time homebuyer puts down 9%, but our program allows you to move in with just 2%!

✅ Start Building Equity from Day One – Every payment helps you own a larger portion of your home.

✅ Enjoy Fixed, Lower-Than-Mortgage Payments – Unlike rent or a traditional mortgage, our payments never increase year to year.

✅ Skip Closing Costs and Buyer’s Agent Fees – Our program eliminates these expenses, saving you thousands upfront.

✅ Buy When You’re Ready—No Pressure – Unlike a traditional mortgage, you can purchase when it makes the most financial sense for you.

What If You’re Not Ready to Buy? Why Waiting Will Cost You

Many renters believe they should wait until they’re “ready” to buy. But the longer you wait, the harder homeownership may become.

Here’s Why:

🚨 Home Prices Keep Rising – Every year you wait, home values increase—meaning you’ll pay more for the same home later.

🚨 Rents Are Outpacing Income Growth – Wages haven’t kept up with rising rent prices, making it harder to save for a home.

🚨 Mortgage Interest Rates Are Unpredictable – While rates may fluctuate, home values historically only move in one direction—up.

With our Lease-to-Own program, you don’t have to wait. You can secure a home today, start building equity immediately, and buy when you’re ready.

Renting vs. Buying: The Long-Term Impact

Let’s put this into perspective. Imagine you’re paying $2,000/month in rent. Over five years, you will have spent:

💸 $120,000 on rent—with nothing to show for it.

Now, imagine you move into a Lease-to-Own home with fixed payments and equity-building from day one.

🏡 In five years, you could have built thousands in home equity—all while living in a home you could eventually own outright.

The Bottom Line: Renting is Temporary—But Homeownership Builds Wealth

The data is clear: renting is getting more expensive, while homeownership continues to be the key to long-term financial stability.

If you’re ready to stop renting and start building equity in a home of your own—without the hurdles of a mortgage—we’d love to guide you through our financially sound Lease-to-Own program.

Take the Next Step Toward Homeownership Today

📞 Call us at 984-363-4379 or Click to Learn How You Can Own Your Home for 2% Down

💡 Your search begins and ends with us.

#LeaseToOwn #StopRentingStartOwning #BuildWealth #HomeEquity #FirstTimeHomebuyer #FinanciallySavvy #AffordableHomeownership #RentingVsOwning #SmartHomeBuying